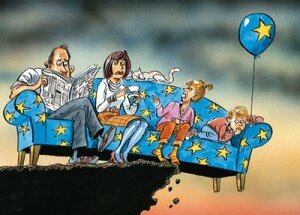

Europe Needs Some Bonding Time

If Europe was a feuding family, it would be time to seek professional counceling.Like most struggling families these days, their problems are financial. Greece has been the black sheep of the family, having been childish with its money, spending too much, working too little, and all the while consistently hiding its dirty laundry in the closet. To get things back in order, disciplinary sanctions have been put together within a massive bailout package.

“Eurobonds are something new. You can’t say what they are like because they do not exist yet. It is an experiment. They would be bonds issued, not by a government, but by a supranational organization. It might even be unique, mostly bonds are issued by a state.“ says Dr. Jeroen Heuts, at the Hogeschool Utrecht.

Dr. Heuts points out there is still no conclusion on what Eurobonds are and who would be in charge of them, if they are ever implemented.

Germany Says No

Firstly, eurobonds work to pool sovereign debt, enabling countries like Greece access to bonds with better interest rates than their own. For the citizens in countries with big financial problems this would lead to cheaper loans but also big budget cuts. For Germany and other well-performing countries, the reverse would occur. This is their first reason to oppose eurobonds.

“Eurobonds are an absolute mistake. To have common interest rates, you need similar levels of competitiveness and similar budgetary situations,” said German Chancellor Angela Merkel last month in the EU Observer.

Secondly, Germany feels that this would ease pressure on those struggling countries to get their act together. All talks about eurobonds has so far included more fiscal control. “It has to be clear that eurobonds, in whatever shape or form they are to be introduced, would have to be accompanied by a substantially reinforced fiscal surveillance and policy coordination,” said Vice President of the Commission, Vivian Reding earlier last month.

“It will take some years before they are introduced. It is not something that they are going to decide on over a night. This is the beginning of a discussion to develop the idea of the concept of bonds issued by a supranational organization,” Mr. Heuts says.

According to Mr. Heuts one of the most important things to do right now is to lessen the gap between the countries in the south and the north. “I feel like there should come at a certain moment but only if the is a convergence, so only if the economic performance is comparable, then it would make sense to have these bonds. But we are far away from that.”